Ever feel like you’re swimming upstream against a tide of confusing economic news? You’re not alone. Understanding consumer sentiment is crucial – not just for economists and businesses, but for you. It’s the collective mood of us, the spenders, the savers, the ones who drive the economy. Let’s be honest, it can feel a bit abstract, but trust me, it impacts your daily life more than you think.

What Exactly Is Consumer Sentiment, Anyway?

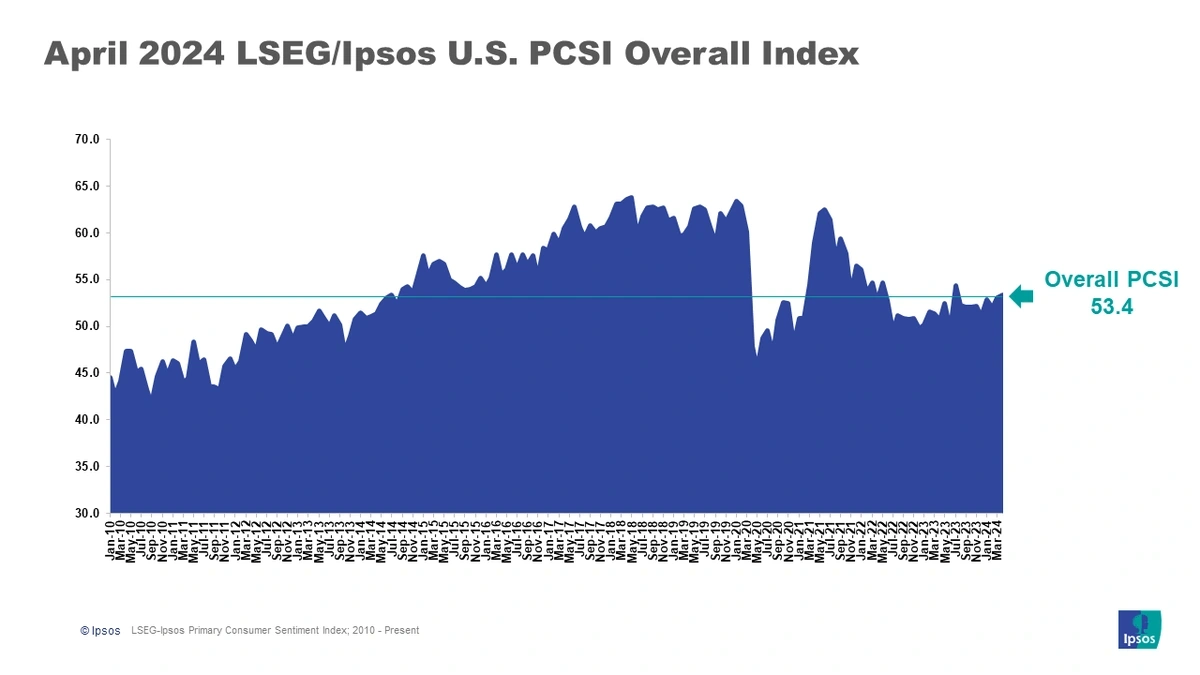

Consumer sentiment is essentially the overall feeling or attitude that consumers have about the economy and their own financial situation. Are they optimistic? Pessimistic? Cautious? It’s not just about having money in the bank; it’s about how people feel about their financial prospects. This is measured through surveys asking consumers about their spending and savings plans. Think of it as a national mood ring, reflecting how secure or insecure people feel about their financial future and the economy at large. And that, my friend, directly impacts how much we’re willing to spend – or not.

Why Should You Care About Consumer Sentiment?

Here’s the thing: consumer confidence directly affects the economy. When people are confident, they spend more. This fuels economic growth, creates jobs, and generally makes things brighter. But when confidence dips – maybe due to fears of a recession or job losses – people tighten their purse strings. They postpone big purchases, save more, and this slowdown in spending can actually cause the very recession they were worried about! It’s a self-fulfilling prophecy. So, paying attention to economic indicators like this one can give you a head start on preparing yourself and your family.

What fascinates me is how quickly it can change! A single piece of news – a surprise interest rate hike or a major company announcing layoffs – can send shockwaves through consumer confidence, leading to a sudden shift in spending habits.

The Indian Context: Unique Factors at Play

Now, let’s bring it home. India has its own unique set of factors that influence consumer sentiment. Unlike some Western economies, India’s consumer sentiment is heavily influenced by things like the monsoon season (affects agricultural income), political stability, and even cultural events like festivals. A good monsoon, for instance, often leads to a surge in rural spending, boosting overall market trends.

And let’s not forget the impact of government policies. A new tax law or a major infrastructure project can significantly alter people’s perceptions of the economy. The Reserve Bank of India (RBI) closely monitors these factors when making monetary policy decisions. The one thing I absolutely must highlight is the rise of digital payments! This is radically reshaping buying behaviours and making it easier to track spending habits. But, the digital divide means not all consumers are created equal. Rural areas can be lagging in digital adoption, which creates a divergence in consumer behaviors.

How to Use Consumer Sentiment to Your Advantage

So, how can you, as an individual, use this information to your advantage? Firstly, stay informed. Keep an eye on news reports that talk about consumer sentiment indices and economic outlook. Don’t just read the headlines; try to understand the underlying reasons behind the shifts in sentiment.

Secondly, be aware of your own biases. Our personal feelings about the economy can cloud our judgment. Try to look at the data objectively. Use it to make informed decisions about your spending, saving, and investments. For example, if consumer sentiment is low and a recession seems likely, it might be a good time to build up your emergency fund and avoid taking on unnecessary debt.

Conversely, if sentiment is high and the economy is booming, you might feel more comfortable making bigger investments or pursuing new business ventures. It’s a bit like sailing; you need to constantly adjust your sails based on the wind direction.

The Future of Consumer Sentiment Analysis

What’s really exciting is how technology is changing the way we understand consumer sentiment. We’re moving beyond traditional surveys to using things like social media analysis and artificial intelligence to get a real-time pulse on consumer attitudes. Imagine being able to track consumer sentiment based on the language people are using on Twitter or Facebook! This could provide incredibly valuable insights for businesses and policymakers.

However, there are also challenges. Ensuring data privacy and avoiding biases in algorithms are crucial. The key is to use these tools responsibly and ethically. I initially thought this was straightforward, but then I realized just how nuanced the data can be. For example, sarcasm can be difficult for AI to detect, which could skew the results. But, the potential benefits are enormous. Think more targeted advertising, better economic forecasting, and policies that are more responsive to the needs of the people. We could even predict shifts in purchasing power and plan better for them.

FAQ About Consumer Sentiment

What if I don’t understand economic jargon?

No worries! Focus on the general trend – is sentiment going up or down? News sources often explain the key takeaways in plain language.

Where can I find reliable information on Indian consumer sentiment?

Look for reports from the Reserve Bank of India (RBI), reputable financial news outlets, and research institutions.

Can consumer sentiment be manipulated?

Potentially, yes. That’s why it’s important to be critical of the information you consume and look at multiple sources. Always question authority.

How often is consumer sentiment measured?

Various surveys are conducted regularly, some monthly, others quarterly. The frequency varies depending on the specific index.

Ultimately, understanding consumer sentiment is about understanding people – their hopes, their fears, and their expectations for the future. It’s a complex and ever-changing landscape, but one that’s worth navigating. After all, it’s our collective sentiment that shapes the world around us. Consider it a vital piece of the puzzle as you navigate your financial life in India. You can also consider consumer sentiment plummets and its effect on businesses.

Leave feedback about this