Okay, let’s be honest: hearing about any potential changes to student debt makes most of us in India sit up and take notice. Why? Because so many Indian families are now sending their kids to the US for higher education. Trump’s name being attached to a potential sale of America’s student loan debt? It’s more than just news; it’s a possible game-changer. This isn’t just about numbers on a balance sheet; it’s about dreams, futures, and the very idea of accessing quality education.

So, what’s the real deal here? Let’s dive in.

The Elephant in the Room | Why Sell Student Loan Debt?

The big question looming is: why even consider selling off this massive portfolio of federal student loans ? Well, the US government holds a staggering amount of student loan debt – we’re talking trillions of dollars. Selling it off to private entities could, in theory, free up government capital. But here’s the thing: it’s not that simple. There are HUGE implications.

One of the biggest reasons being whispered about is the idea of offloading risk. The government is essentially saying, “Hey, this is a potentially unstable asset; someone else can deal with the headache of collecting these debts.” What fascinates me is the long term effects of the government offloading such responsibility.

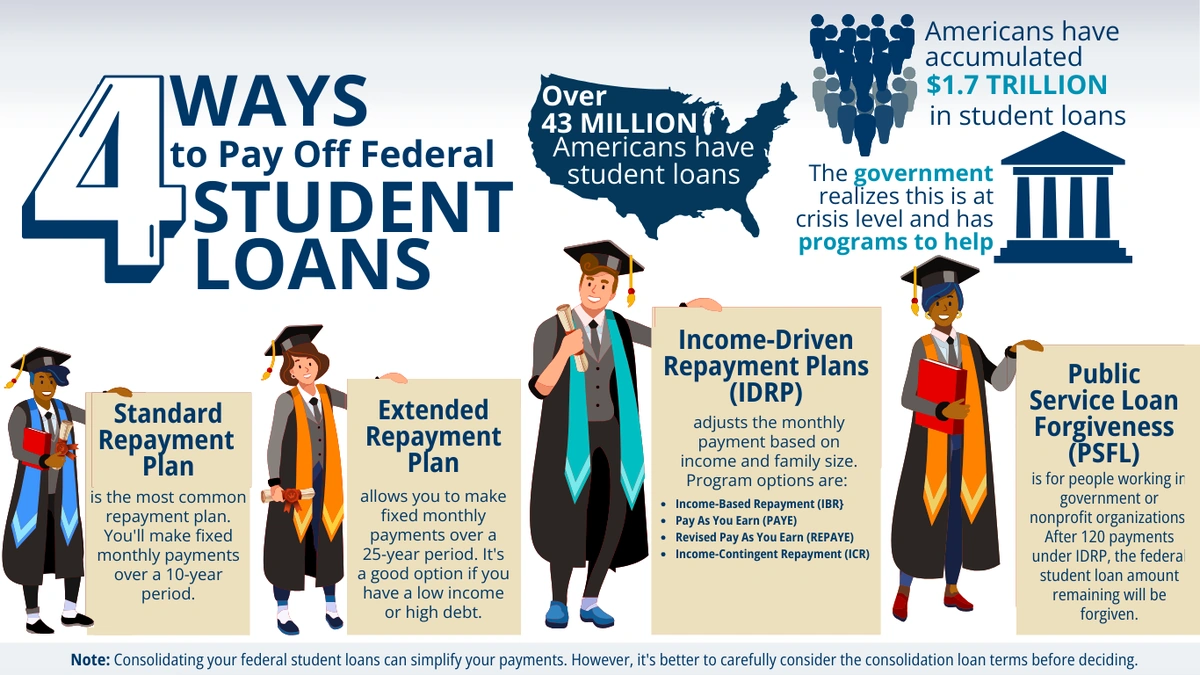

And the LSI keywords to think about here are student loan forgiveness programs , federal loan servicing , interest rates on student loans , and income-driven repayment plans . These all come into play when considering the motivations behind a potential sale.

The Indian Connection | Why Should We Care?

Now, you might be sitting there thinking, “Okay, this is happening in America. What’s it got to do with me sipping chai in Delhi?” Here’s the thing. India is now a significant source of international students in the US. A large percentage of these students rely on loans – often US federal loans – to finance their education. If these loans are sold to private companies, the repayment terms could change drastically.

We’re talking potentially higher interest rates, stricter repayment schedules, and less flexibility when it comes to deferment or forbearance. For Indian students, many of whom are already stretching their finances to the limit, this could mean increased stress and a real risk of default. We need to be talking about international student loans , and how this plays into the bigger picture.

Think of it this way: families invest everything they have in their child’s education abroad. A sudden shift in loan terms could throw their entire financial plan into disarray. This highlights the interconnectedness of global finance and individual lives .

The Potential Fallout | A Student’s Nightmare?

So, what’s the worst-case scenario? Imagine this: you’re an Indian student who took out a loan to study engineering in the US. You graduate, ready to take on the world, but then your loan servicer changes. The new company is less understanding, less flexible. They’re focused on profit, not people. Suddenly, you’re facing mounting debt, struggling to make payments, and your credit score is taking a nosedive. The dream of a better future starts to feel like a distant memory.

That’s a real possibility. The private sector is incentivized to maximize profits. While not all private loan servicers are predatory, the risk is definitely there. It is important to check the student loan refinancing options , and private student loan consolidation to know the full impact on loans.

But, it is also important to note, that even though this news may be alarming there could be potential upsides of this change. These may not be apparent and that is something to consider.

Navigating the Uncertainty | What Can Students Do?

Okay, so what can students and their families do to prepare for this potential shift? Firstly, stay informed. Keep a close eye on developments in US education policy. Follow reputable news sources and organizations that advocate for students’ rights. Secondly, understand your loan terms inside and out. Know your interest rates, repayment options, and any potential fees. Thirdly, explore all available resources. Talk to financial advisors who specialize in international student loans. Look into scholarships, grants, and other forms of financial aid.

Here’s a practical tip: Document everything. Keep records of all communication with your loan servicer. Save copies of your loan agreements and repayment schedules. This could be invaluable if disputes arise in the future. Also ensure that student loan debt relief is available if the worst case scenario happens. And here’s a crucial point: don’t panic . Knowledge is power. The more you understand the situation, the better equipped you’ll be to navigate it.

The Bigger Picture | Education as a Commodity?

This whole situation raises a fundamental question: Should education be treated as a commodity? Should access to knowledge and skills be determined by profit margins? For many, the answer is a resounding no. Education is an investment in the future – not just for individuals, but for society as a whole. When we prioritize profit over people, we risk creating a system where only the wealthy can afford to reach their full potential.

This isn’t just about student loan interest deduction or student loan default rate . It’s about the kind of world we want to create. Do we want a world where everyone has the opportunity to learn and grow, or one where education is a privilege reserved for a select few? This decision about student loans will impact everything and everyone involved.

FAQ Section

Frequently Asked Questions

What exactly does it mean for my loan to be “sold?”

It means the ownership of your loan is transferred from one entity (likely the government) to another (potentially a private company). The terms of your loan shouldn’t change immediately, but the new servicer might have different customer service practices or offer different repayment options in the future.

Could my interest rate go up if my loan is sold?

Potentially, yes. While the initial terms should remain the same, a private company might have the ability to change the rates later, or when you try to refinance. Always read the fine print!

What if I’m already on an income-driven repayment plan?

That’s a key question to ask your new loan servicer. Confirm whether they will honor your existing income-driven repayment plan. Get it in writing.

What if I’m having trouble making payments after the sale?

Contact your new loan servicer immediately. Explore your options for deferment, forbearance, or revised repayment plans. Don’t wait until you’re in default.

Where can I find reliable information about these changes?

Stick to official sources like the US Department of Education website ( www.ed.gov ) and reputable news outlets.

So, here’s the thing: this potential sale of America’s student loan portfolio is a wake-up call. It forces us to think critically about the value we place on education, the role of government in ensuring access, and the potential consequences of prioritizing profit over people. And I initially thought this was straightforward, but then I realized it really makes you think about long-term impacts, not just immediate changes!

Leave feedback about this