So, you’re dreaming of that fancy degree, huh? Maybe a Masters in Data Science from a top university, or perhaps a specialized engineering program abroad? The only thing standing between you and that dream is, well, the hefty price tag. That’s where education loans come in. But let’s be honest – wading through the world of interest rates and loan terms can feel like trying to decipher ancient Sanskrit. What fascinates me is how much these rates can vary, and how a little knowledge can save you a whole lot of money over the loan’s lifetime.

Why Education Loan Interest Rates Matter More Than You Think

Here’s the thing: when you’re staring at a massive tuition bill, a few percentage points on an education loan interest rate might seem insignificant. But trust me, they’re not. Over the standard loan repayment period (usually 5-7 years, but it can stretch longer), even a seemingly small difference in the interest rate can translate to thousands, even lakhs, of rupees. Imagine what you could do with that extra cash – a down payment on a car, a dream vacation, or even just a cushion for those unexpected life expenses.

But it’s not just about the money. The interest rate you secure directly impacts your monthly EMI (Equated Monthly Installment). A lower interest rate means a lower EMI, which gives you more breathing room in your budget, especially in those early career years when you’re just starting out. This can significantly reduce financial stress and allow you to focus on your career growth without constantly worrying about making ends meet. Remember that feeling of relief? That’s what securing a good student loan can provide.

Decoding the Latest Interest Rate Landscape | Top Banks in India

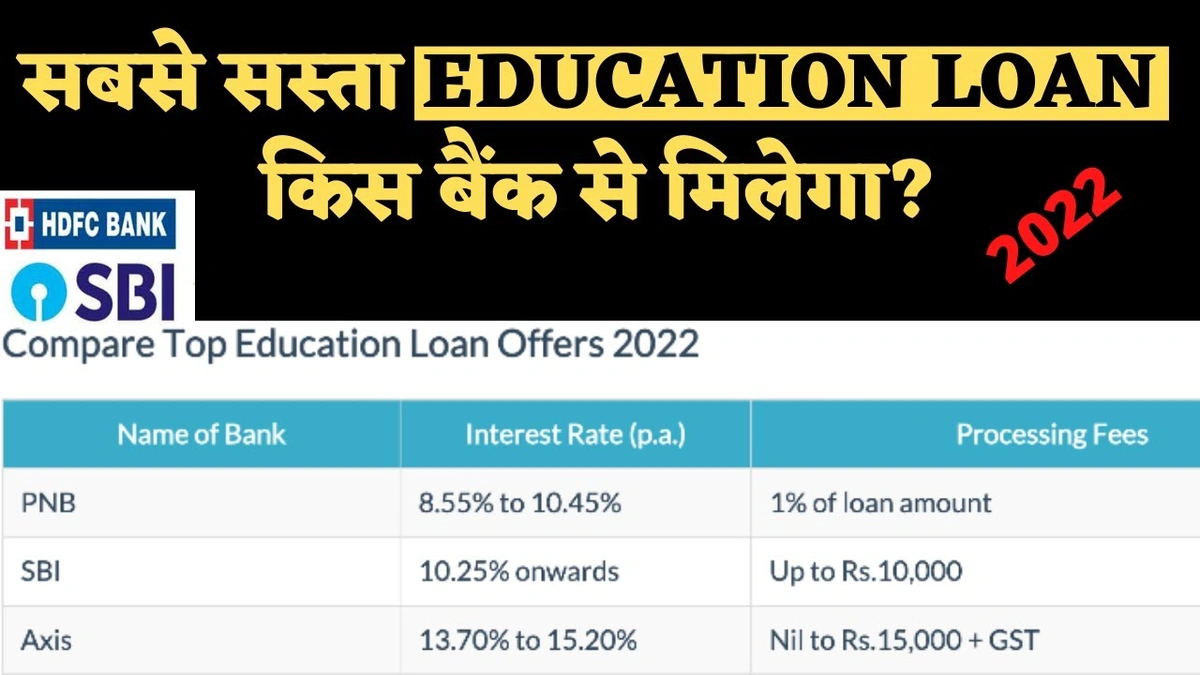

Alright, let’s get down to brass tacks. Here’s a peek at what some of the major players in the Indian banking sector are offering in terms of education loan interest rates . Now, I won’t throw a bunch of numbers at you without context. Interest rates are like snowflakes – no two are exactly alike. They depend on a bunch of factors, including the loan amount, your credit score (or your co-applicant’s), the type of course you’re pursuing, and the bank’s current lending policies.

Generally speaking, public sector banks (like SBI, PNB, and Bank of Baroda) tend to offer slightly lower interest rates compared to private sector banks (like HDFC Bank, ICICI Bank, and Axis Bank). This is often because public sector banks have government backing and are mandated to promote education. But don’t let that be the only deciding factor! Private banks might offer faster processing times, more flexible repayment options, or additional benefits like insurance coverage or travel assistance. According to the official website of SBI , they have specially tailored schemes for students.

When evaluating these offers, pay close attention to the fine print. Look for any hidden charges, processing fees, or prepayment penalties. Also, find out whether the interest rate is fixed or floating. A fixed rate gives you the security of knowing exactly how much you’ll be paying each month, while a floating rate fluctuates with market conditions (which could be a good or bad thing, depending on how things go!).

The “How To” of Getting the Best Education Loan Interest Rate

Okay, so you know why education loan interest rates matter and you have a general idea of what’s out there. Now, let’s talk strategy. How do you actually snag the best possible deal?

1. Ace Your (or Your Co-Applicant’s) Credit Score: This is HUGE. A good credit score signals to the bank that you’re a responsible borrower. Work on improving your credit score well in advance of applying for a loan. Pay your bills on time, keep your credit utilization low, and avoid applying for too many loans or credit cards at once. A common mistake I see people make is assuming their credit score doesn’t matter for an education loan, especially if their parents are co-signing. While the co-applicant’s score is important, having a good score yourself shows responsibility.

2. Shop Around: Don’t settle for the first offer you get. Compare rates and terms from multiple banks and lending institutions. Use online comparison tools to get a quick overview of the market, but also visit the banks in person to discuss your specific needs and negotiate for a better rate. Remember, everything is negotiable!

3. Consider a Secured Loan: If you have collateral to offer (like property or fixed deposits), you might be able to secure a lower interest rate on your education loan. Secured loans are generally considered less risky by banks, so they’re willing to offer better terms. If you are a small business owner, consider checking more details here about loan returns and other considerations.

4. Look for Government Subsidies: The Indian government offers various schemes and subsidies to promote education, especially for students from economically weaker sections. Check if you’re eligible for any of these programs, as they can significantly reduce your interest burden. According to the latest information on the Ministry of Education website, there are ongoing initiatives to support higher education for marginalized communities.

5. Maintain a Good Relationship with Your Bank: If you already have a savings account or other financial products with a particular bank, they might be more willing to offer you a preferential interest rate on your education loan. Loyalty can pay off!

The Long Game | Repaying Your Education Loan Strategically

Securing a good education loan interest rate is only half the battle. The real challenge lies in repaying the loan responsibly and efficiently. Here are a few tips to help you stay on track:

1. Start Early (If Possible): Many banks offer a moratorium period (a grace period) during your studies and for a few months after graduation. However, interest still accrues during this period. If you can afford to make small interest payments during the moratorium, it will significantly reduce your overall debt burden.

2. Automate Your Payments: Set up automatic EMI payments from your bank account to avoid late fees and ensure timely repayment. This also helps improve your credit score over time.

3. Explore Prepayment Options: If you come into some extra money (bonus, inheritance, etc.), consider prepaying a portion of your loan. This will reduce your outstanding principal and save you on future interest payments. Check if your bank charges any prepayment penalties before doing so.

4. Refinance if Necessary: If interest rates drop significantly after you’ve taken out your loan, consider refinancing to a lower rate. This can save you a substantial amount of money over the remaining loan term. But keep in mind that refinancing might involve some fees and paperwork.

I initially thought this was straightforward, but then I realized just how personalized the whole process is. Each student’s financial situation and academic goals are unique, and the best student loan strategy must reflect that. It’s not a one-size-fits-all kind of deal.

Education Loan Options Beyond Banks | Exploring Alternative Financing

Beyond traditional banks, several alternative financing options are emerging for education loans. These include Non-Banking Financial Companies (NBFCs) and peer-to-peer lending platforms. NBFCs often offer more flexible loan terms and may be more willing to lend to students with less-than-perfect credit scores. Peer-to-peer lending platforms connect borrowers directly with investors, potentially offering lower interest rates than traditional banks. However, it’s crucial to carefully research these alternative options and understand their terms and conditions before committing. As per the guidelines mentioned in the information bulletin from the RBI, it’s very important to check the accreditation of these companies.

These are the things you must do before considering education options outside India, consider reading this article here .

FAQ Section

Frequently Asked Questions (FAQs)

What is the typical repayment period for an education loan?

The typical repayment period ranges from 5 to 7 years, but can extend up to 10 years or more depending on the loan amount and the lender’s policies.

Can I get an education loan without a co-applicant?

It depends on the lender and the loan amount. For smaller loan amounts, some banks may offer loans without a co-applicant. However, for larger loans, a co-applicant (usually a parent or guardian) is typically required.

What happens if I can’t repay my education loan on time?

Late payments can damage your credit score and lead to penalties. If you’re struggling to repay your loan, contact your lender as soon as possible to discuss options like restructuring your loan or temporarily suspending payments.

Are there any tax benefits on education loan interest payments?

Yes, under Section 80E of the Income Tax Act, you can claim a deduction on the interest paid on your education loan. This deduction is available for a maximum of 8 years or until the interest is fully repaid, whichever is earlier.

What if I want to change my course after getting the loan disbursed?

You need to inform the bank. Changing your course could affect your loan terms, so it’s important to get approval from the lender.

So, to wrap it all up, navigating the world of education loan interest rates is all about doing your homework, understanding your options, and making informed decisions. With a little research and planning, you can secure the financing you need to pursue your academic dreams without breaking the bank. Good luck, and may your future be bright!

Leave feedback about this